Amica Update Home Lender

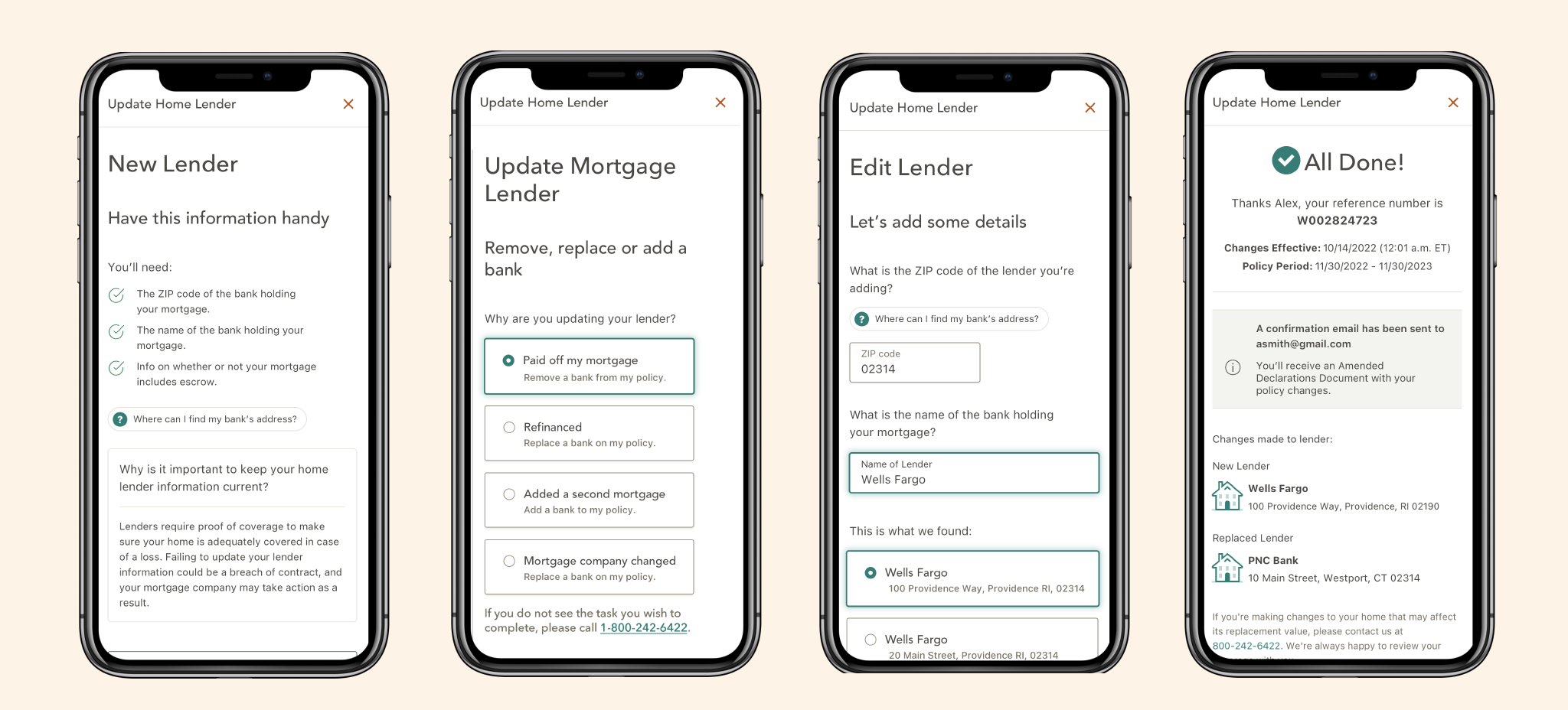

The new Update Home Lender wizard breaks up questions that the user often overlooked when they were combined on the same page.

Project Overview

Fall 2022

Ensuring your home insurance provider has up-to-date details about the bank backing your mortgage is crucial. Following a revamp of the Update Home Lender feature, Amica experienced a 30% increase in task completion.

Implementation took an MVP approach. Initially, the focus was on refining the copy and design within the Update Home Lender process. A second iteration added the option to eliminate a bank from one's policy was integrated, addressing a frequent request from customers who had cleared their mortgage debt.

-

I created two potential design directions for the component, oversaw research, created prototypes for testing, and worked with developers throughout handoff.

-

My Design Lead was a huge help when it came guidance on the process and accessibility research (read more below) along with recommending swiping functionality for mobile users.

-

The researcher helped formulate the “task” and conducted A/B testing to determine the design direction (see more below)

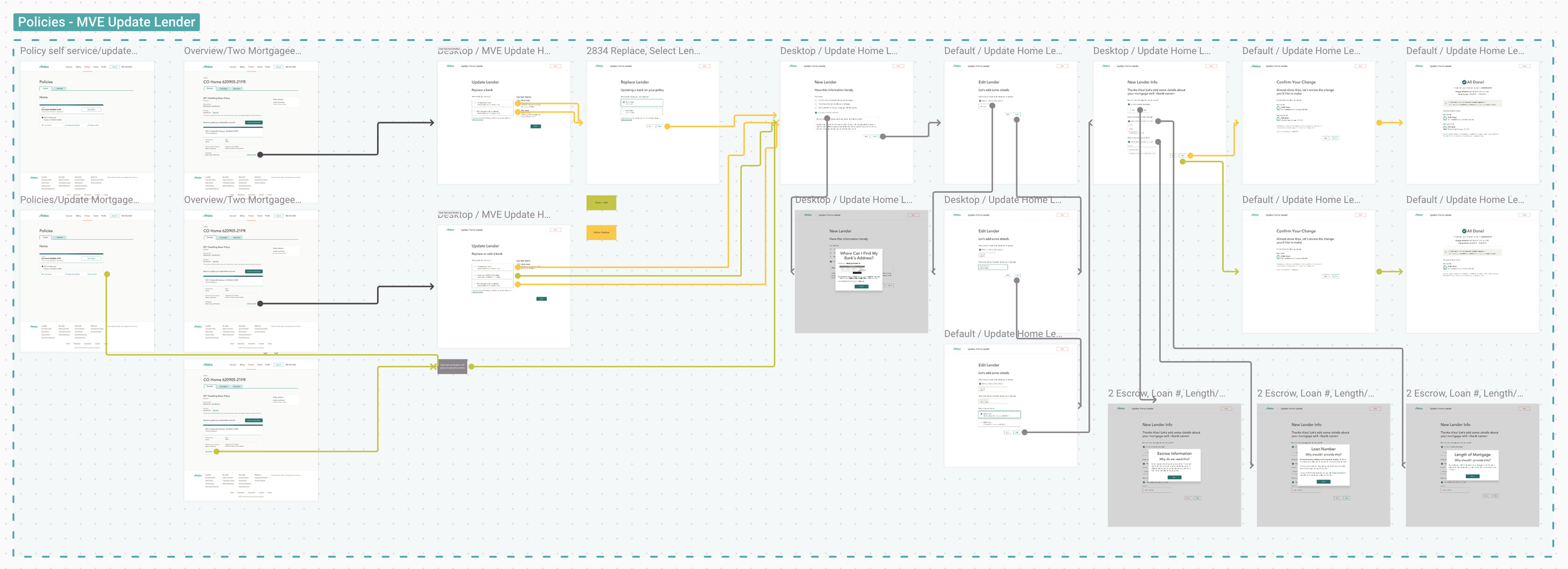

The design flow was planned in two iterations: a Minimum Viable Experience (MVE) initially, followed by a second iteration, adding the ability to remove a bank from your policy.

The second iteration added the ability to remove your lender from your policy. Color key: Red = remove flow, Yellow = update flow, Green = add flow.

Research

The alternate design allows the user to configure their lender information in a tab.

The wizard version (preferred) took users through guided steps to updating their bank.

re-Naming

Originally named "Edit Mortgagee," the feature underwent a renaming process to "Update Home Lender" following research findings.

When users update their information, it’s often to add or remove their current bank for various reasons. Our study revealed that users didn’t associate the term "Edit" with “Add” or “Remove.”, so we switched to "Update" for clarity.

We also questioned the term “mortgagee.” The study uncovered that 75% of older home buyers and only 67% of younger home buyers knew the meaning behind mortgagee, but 98% of older home buyers and 91% of younger home buyers recognized the term “Lender.”

A/B Test

The existing Update Lender feature followed a wizard format, but I questioned if this was the best experience. Recent data revealed that users could access policy coverage updates through a tab or button click on the page, and the tab outperformed the button so I questioned if this would be the case for managing your banks as well.

A/B testing confirmed that users favored the wizard experience, providing us with an opportunity to evaluate the usability of the new design and the feature's name.

Redesign work

During the MVE iteration, I focused on cleaning up the copy and design. This included adding help information, illustrations, and addressing issues with the overall flow. Through user observation, I noticed that users often overlooked the first question and jumped to the second one. To address this, we divided the process into multiple steps.

accessbility

The header structure throughout this flow needed updating for accurate screen reader use.

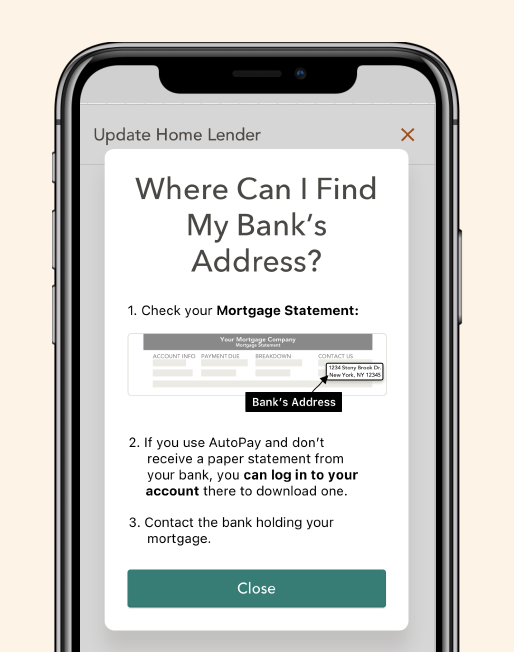

Many users could not find their bank’s address. Information was added to help.

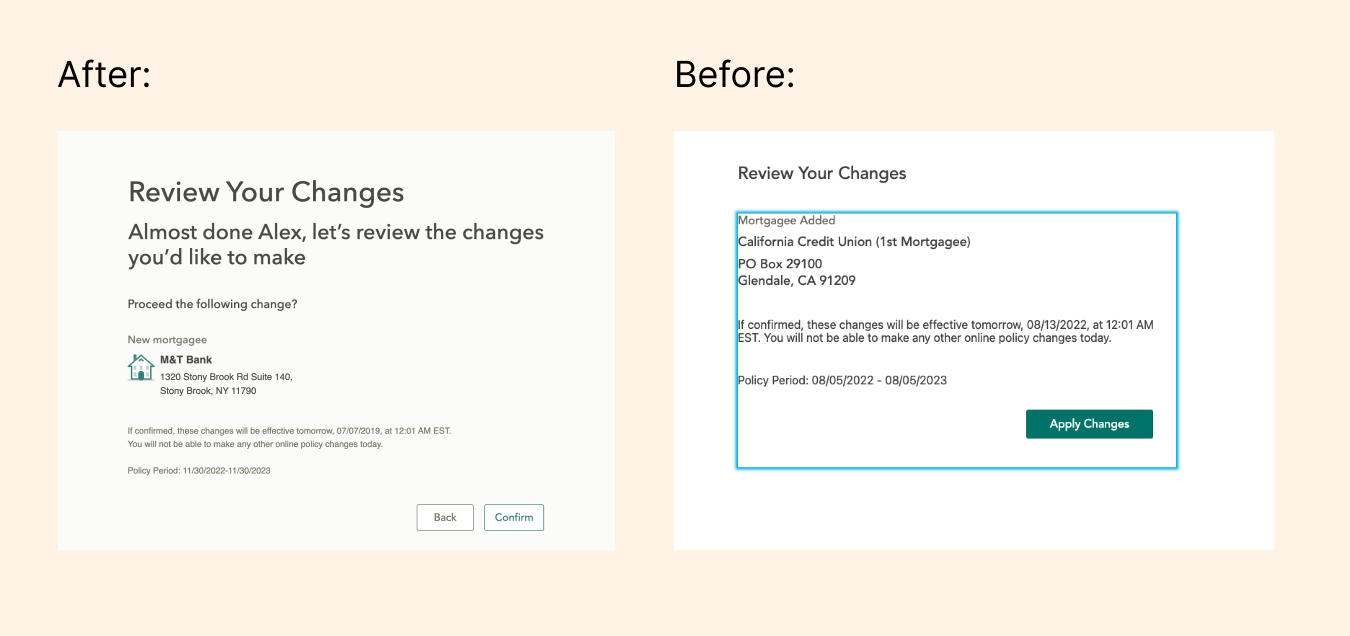

The review page was updated to better group information together and look cleaner.

Future Recommendations

Despite a significant improvement in completion rates, the drop off rates showed some users still unable to make it through the flow. A deeper investigation showed where the drop off was happening during the lender search, and uncovered that the database of banks Amica has on file needed to be improved. This technical limitation was brought to the business to address.